April 8, 2021 15:02 NYDT – Words without their weight in evidence continue to weigh heavily on investors this month. After Federal Reserve Chairman Jerome Powell’s remarks ceased to eliminate fears of rising inflation and its future impact on the value of the US Dollar. And on March 5, 2021, the Big Three @NYSE composite indices, the DOW Jones Industrial (DOW), NASDAQ (NDAQ), and Standard & Poors 500 (S&P 500), all showed their discontent by opening down 346 points (1.1%), 274.3 points (2.1%), and 51.3 points (1.3%), respectively.

On March 11, 2021, President Biden signed the 1.9 Trillion Dollar Stimulus Bill into law, contributing to the Big Three composite indices recording a seven day winning streak.

On March 17, 2021, the DOW Jones Industrial (DOW) Composite index broke its seven day winning streak by falling 127.5 points (0.4%) and the Standard & Poors 500 (S&P 500) experienced losses of 6.2 points (0.2%). After factories became #cognizant of the extensive damage tally of over $600 million dollars in Texas alone from what has been #dubbed the Winter Storm Massacre; causing industrial production to #plummet. The NASDAQ (NDAQ) stayed afloat with gains of 11.9 points (0.1%), given it is the index dominated by Big Tech companies which are striving on online sales. Retail sales, however, declined from a lapse in governmental aid; of which, was blamed on the Winter Storm Massacre.

Investors moved heavily away from Big Tech stocks on the NASDAQ (NDAQ) Composite index on March 19, 2021, which support the work-at-home corporate sector, given a forecasted economic rebound in cyclical sectors from a spike in US Treasury yields. Leading the NASDAQ (NDAQ), DOW Jones Industrial (DOW), and the Standard & Poors (S&P 500) Composite indices to plunge 409 points (3.0%), 153.1 points (0.5%), and 58.7 points (1.5%), respectively.

Resulting in all the Big Three Composite indices, respectively above to close down for the week 81.7 points (0.6%), 107.1 points (0.3%), 17.0 points (0.4%).

President Biden released details on his “Build Back Better” plan on March 24, 2021 that includes as much as $4 Trillion dollars in fresh government spending over the next decade amidst the skyrocketing US deficit. All of President Biden’s new spending plan is expected to be paid for by raising corporate taxes on any entity grossing over $400,000 per year. All while major European countries increased COVID-19 restrictions impacting travel. This news devastated investors, causing the DOW Jones Industrial (DOW), NASDAQ (NDAQ), and Standard and Poors Composite indices to fall 308.0 points (0.9%), 149.8 points (1.1%), 30.1 points (0.8%), respectively @nyse.

@CBN @nytimes @whitehouse @foxnews @CNN

#thehumanwill #waitandsee

IMPORTANT NOTICE: To protect yourself and your loved ones, consider converting the US Dollar (USD) to Canadian currency (CAD). We have been urging that you watch the markets carefully and when the climate surrounding markets gets very volatile, convert your currency. The US Dollar (USD) is heavily inflated and its stored value is becoming more and more unstable everyday. The website that converts currency without an international bank account is https://www.wise.com.

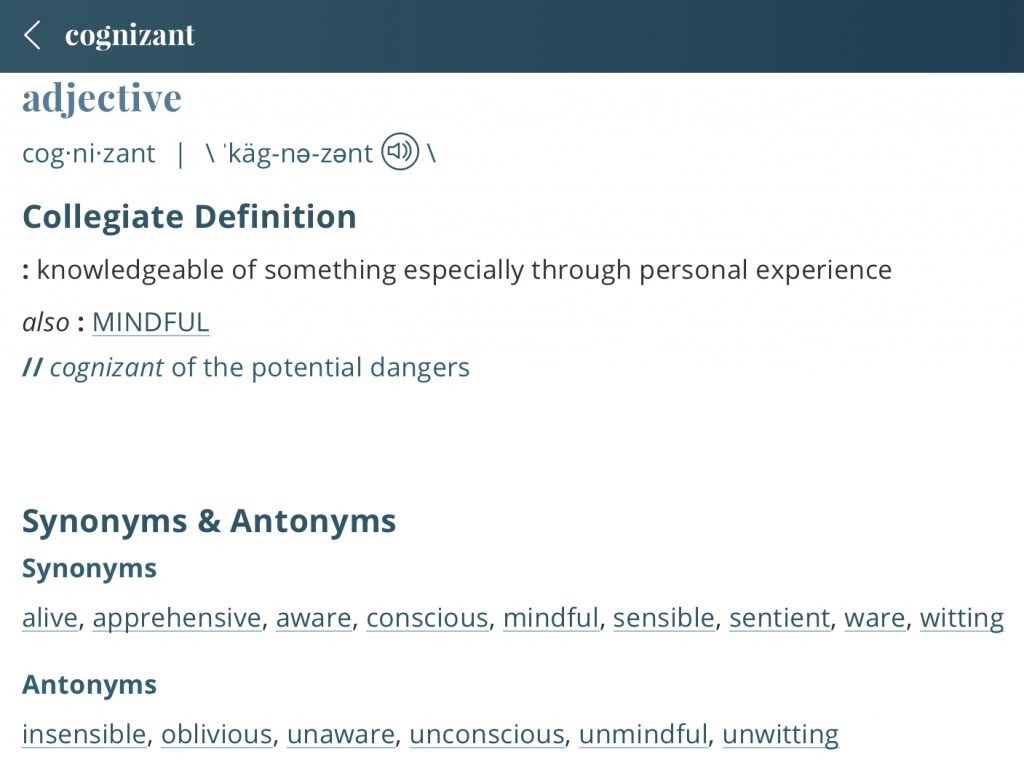

YHWH||ANYAMARY||JESUSISRAEL share a definition, #cognizant:

Merriam-Webster’s definition of “cognizant”

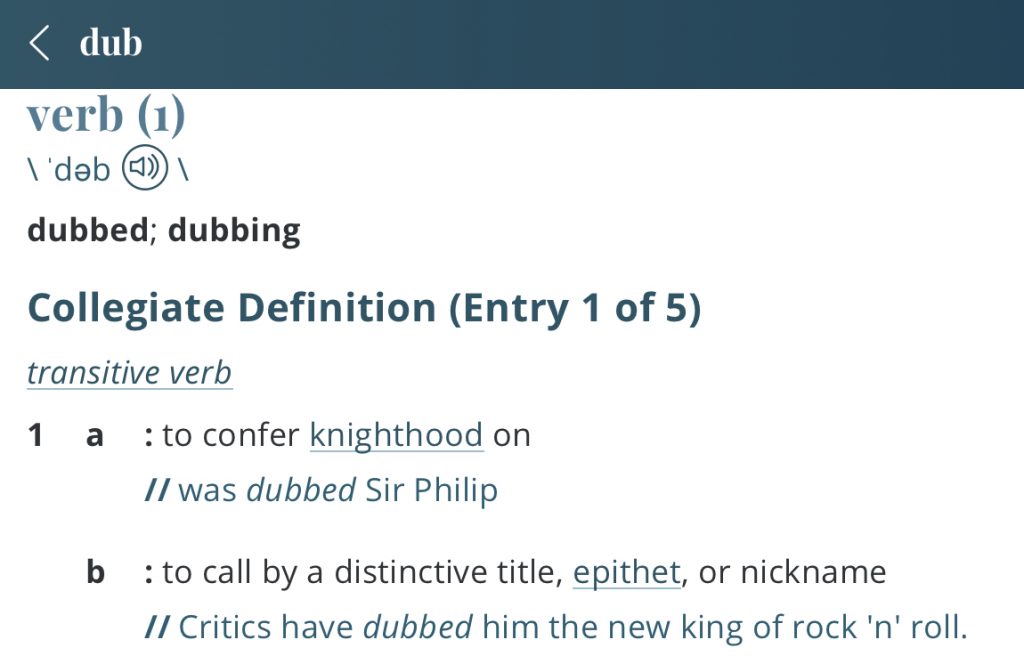

YHWH||ANYAMARY||JESUSISRAEL share a definition, #dub:

Merriam-Webster’s definition of “dub”

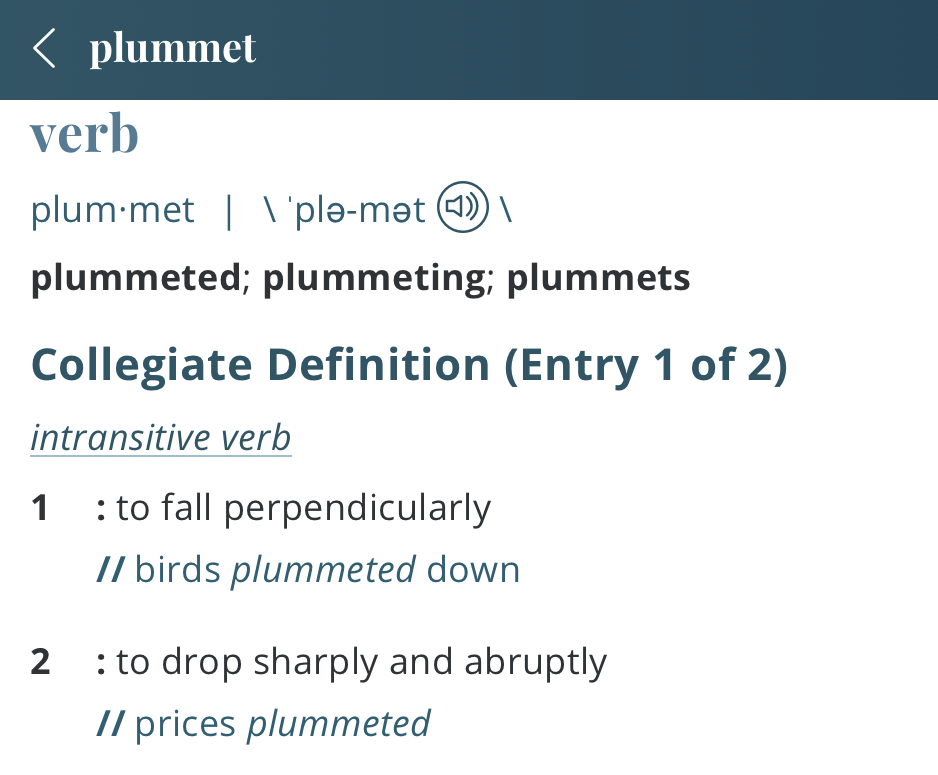

YHWH||ANYAMARY||JESUSISRAEL share a definition, #plummet:

Merriam-Webster’s definition of “plummet”

More Stories

Stock Market News & Reporting April Synopsis

Stock Market News & Reporting February Synopsis

Stock Market News & Reporting Weekend 1/31/21