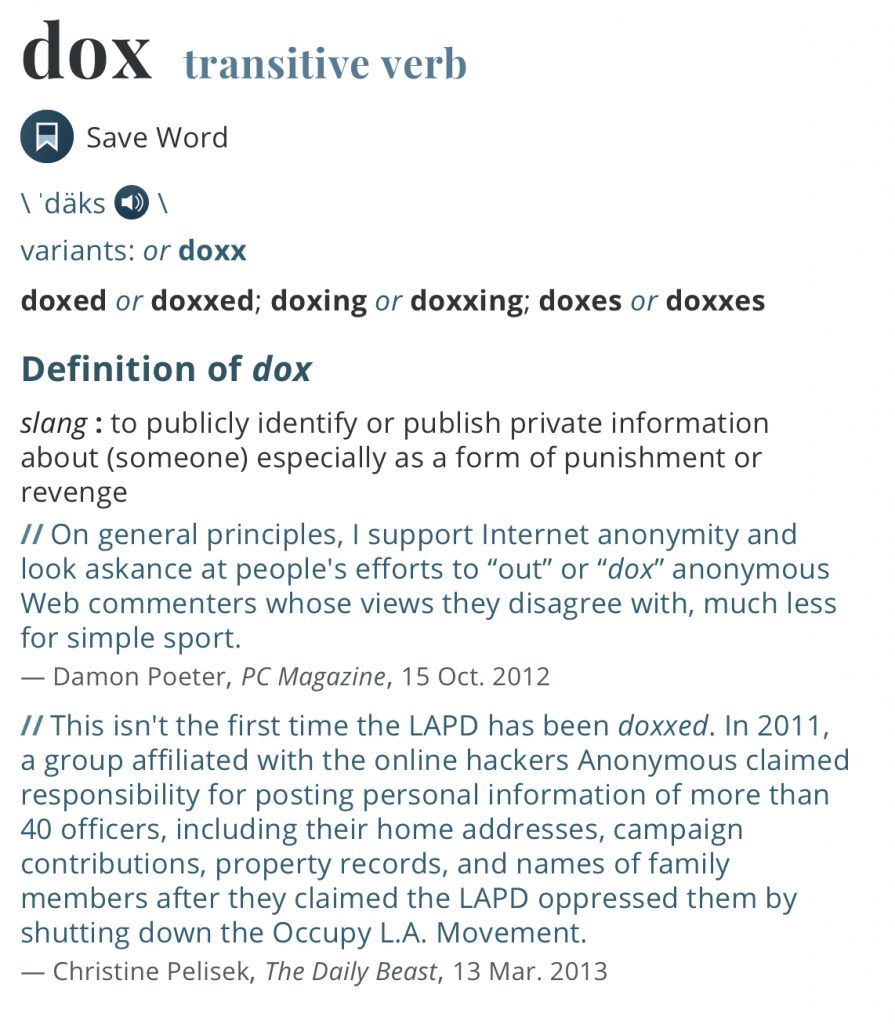

January 31, 2021 23:30 NYST – The war between long sellers and short sellers has intensified to epic proportions. Stocks that have little market value soared this week because of maliciously publicized information about certain companies popular within the short selling market; a practice known as #doxxing.

On @Reddit discussions in a forum, called WallStreetBets went viral, tipping off major hedge funds to assist failing companies by releasing information publicly regarding private business dealings with them.

As bets on @GameStop (GME) and @AMCTheatres (AMC) crashing went viral on WallStreetBets via @Reddit, short sellers hopped on the runaway train by borrowing shares of stock from these companies with the intent of selling them back on the market after the stock price fell; thereby, effectively turning a profit. However, hedge funds with major capital rained on the short sellers parade by assisting the failing companies, then publicizing the information; tipping off long sellers to invest in the stock price going up. Short sellers were caught in a seemingly never-ending vortex of having to continue to borrow up the stock as the price kept increasing, to cover losses on their original bet. The stock price eventually priced out prudent short sellers, as long sellers took their cut before the price fell to a value still too high for short sellers to turn a profit on their original bet.

Doxxed information about @GameStop (GME) communicated investor counsel, relaying for them to exit underperforming stores and close nonessential operations. While doxxed information about @AMCTheatres (AMC) revealed receipt of a $900 million dollar private bailout. Both media reports weren’t based on growth in market value, and yet the information led to dramatic gains of 231.5 points (239.3%) and 8.8 points (193.7%) for @GameStop (GME) and @AMCTheatres (AMC), aggregate since January 25, 2021, respectively.

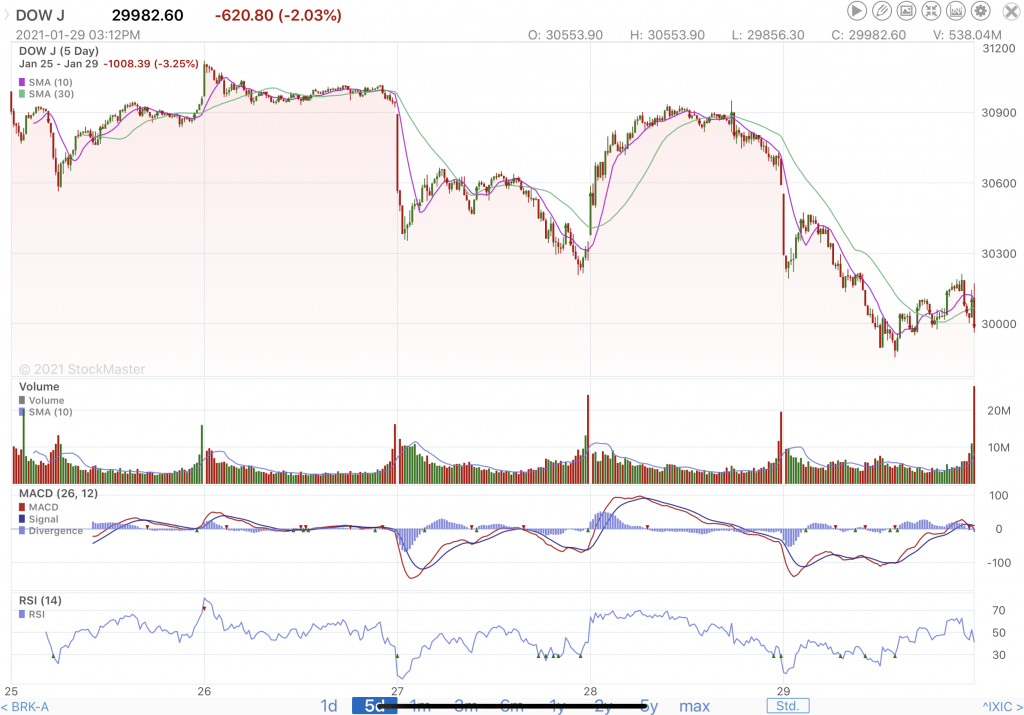

These seemingly innocent gambling games on Wall Street drove the stock futures of the DOW JONES Industrial (DOW), NASDAQ (NDAQ), and Standard and Poor’s (S&P 500) to sink to their worst level prior to tomorrow’s market open since October 2020. With the DOW JONES Industrial (DOW), NASDAQ (NDAQ), and Standard and Poor’s (S&P 500) all recording 5 day losses of 1008.4 points (3.3%), 622.9 points (4.6%), and 138.5 points (3.6%). In addition to Friday’s losses of 620.8 points (2.0%), 266.5 points (2.0%), and 73.1 points (1.9%), respectively @nyse.

#thehumanwill #waitandsee

IMPORTANT NOTICE: To protect yourself and your loved ones, consider converting the US Dollar (USD) to Canadian currency (CAD). We have been urging that you watch the markets carefully and when the climate surrounding markets gets very volatile, convert your currency. The US Dollar (USD) is heavily inflated and its stored value is becoming more and more unstable everyday. The website that converts currency without an international bank account is https://www.transferwise.com.

YHWH||ANYAMARY||JESUSISRAEL share a song, Christian Hip Hop:

YHWH||ANYAMARY||JESUSISRAEL share a definition, #dox:

Merriam-Webster‘s definition of “dox”

More Stories

Stock Market News & Reporting April Synopsis

Stock Market News & Reporting March Synopsis

Stock Market News & Reporting February Synopsis